策略介紹

Strategy Introduction

說明 / Description

- 當出現進場訊號時,於開盤前掛預約單(昨收價+10% 或市價),以開盤價買進。

Place a pre-market order before the market opens (yesterday’s close +10% or market order) to buy at the day’s opening price.

- 出場訊號亦同,於開盤前掛預約單(昨收價-10% 或市價),以開盤價賣出。

For exit signals, place a pre-market sell order (yesterday’s close -10% or market order) to sell at the opening price.

特性 / Characteristics

- 中期波段策略,進出都以開盤價成交,不需盯盤。

- 懶人策略:只需預先掛單即可,免看盤。

- 具備停損機制,有效控制風險。

- Dashboard 回測績效顯示,表現優於長期持有及定期定額。

This is a mid-term swing trading strategy with entry and exit based on market open prices. No need to monitor the market intraday.

Lazy investor friendly: just place orders in advance.

Includes stop-loss mechanism for downside control.

Outperforms long-term holding and dollar-cost averaging (see Dashboard).

Example

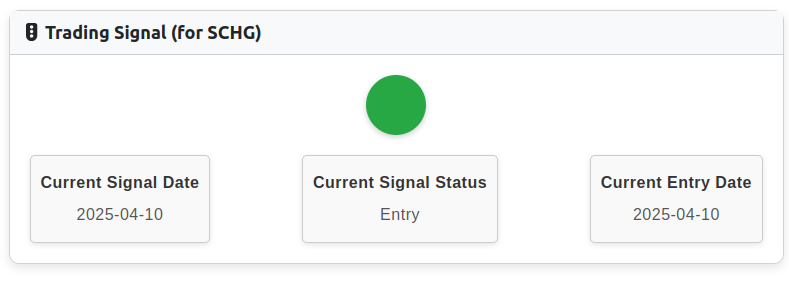

1. SCHG 進場訊號出現在 4/10,當日開盤價 ($24.25) 買進。

Buy signal for SCHG appeared on 4/10. Entered at $24.25 (opening price).

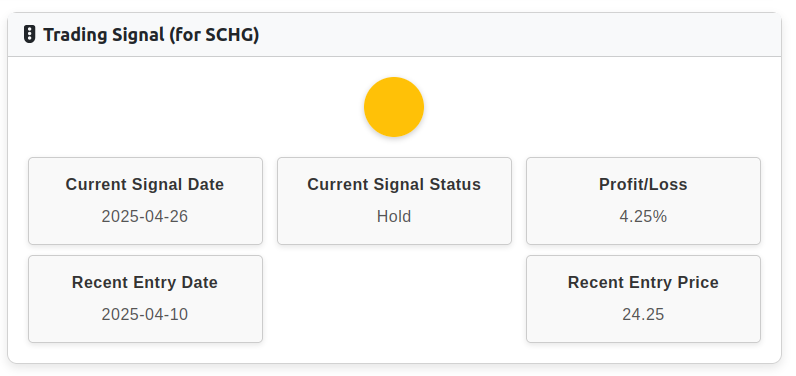

2. 接著等待出場訊號。

Then, wait for the exit signal.

標的選擇 / Asset Selection

本策略採用被動型 ETF,如 SPY / VTI / SCHG。理由是一般投資人難以長期打敗大盤,只要勝過大盤,就等同勝過大多數人。

Passive ETFs are used (e.g., SPY, VTI, SCHG). Most individuals struggle to beat the market long-term. Beating the market = beating most investors.

請注意,所有結果均為模擬數據,僅供學術研究用途,並不代表未來實際收益。

Note: All results are simulated and for educational/research use only. They do not guarantee future returns.

中文

本網站提供的資訊僅供參考,不構成投資建議。所有數據、圖表和交易訊號均基於歷史資料和模擬回測結果,不保證未來的實際表現。投資有風險,盈虧自負,請在做出任何投資決定前諮詢專業財務顧問。本網站及其作者對因使用這些資訊而導致的任何損失不承擔責任。

English

The information provided on this website is for reference only and does not constitute investment advice. All data, charts, and trading signals are based on historical data and simulated backtest results, and do not guarantee future performance. Investing involves risks, and profits or losses are at your own risk. Please consult a professional financial advisor before making any investment decisions. This website and its authors are not liable for any losses resulting from the use of this information.